This week’s edition of Neural Frontiers was exciting to put together for you. As someone looking to build a career investing in innovative Neurotech companies, it was awesome to focus on the capital aspect of the Neurotechnology revolution we are in. The last few weeks of this blog have been a learning experience filled with research, excitement, and optimism for what’s to come. As always, thank you for being a part of this journey. If you missed last week’s post on The State of Neurotechnology, you can go back and give it a lookover. Not only did I break down the important sectors of Neurotechnology that you should know about, but I also gave a heads up of what to expect the next couple weeks as far as content.

I hope you enjoy this week’s blog on investing in Neurotech as much as I enjoyed putting it together for you! P.S – if you’re an AppleTV subscriber, season 2 of Severance is out, and I highly recommend you watch this show if you’re a Neuro-nerd like myself. I don’t want to spoil anything, but this show is fascinating in the sense that you can’t help but ask… How do we balance the benefits of neurotech with the ethical risks?

Welcome to Week 3: Investment Insights

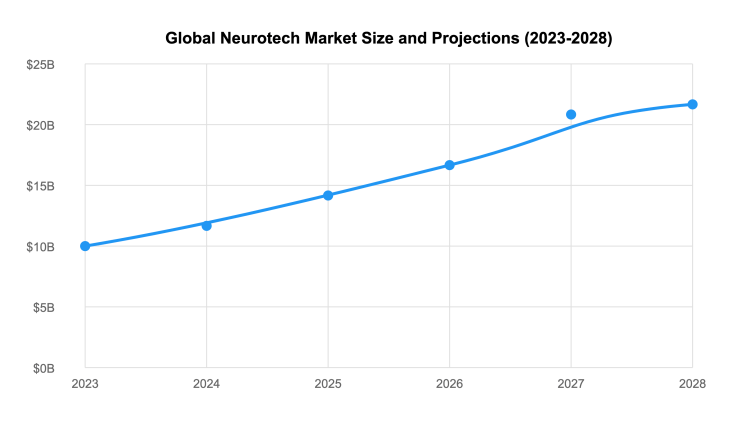

The convergence of neuroscience and technology has unleashed a wave of innovation that’s captured the attention of both scientists and investors. With the global neurotech market projected to reach $24.2B by 2028, venture capitalists are increasingly recognizing the potential of this space. Investment in neurotech startups has seen remarkable growth, with total funding reaching $5.1B in 2024 alone, a 45% increase from the previous year. This surge in investment activity signals a maturing market where breakthrough technologies are increasingly ready for commercialization.

Market Dynamics: Understanding the Landscape

The neurotech sector is experiencing promising growth, driven by several key factors. Early-stage investment has been particularly robust, with seed rounds averaging $3.2M in 2024, up from $2.1M in 2023. Series A rounds have seen even more dramatic increases, with median deal sizes reaching $12.5M, reflecting growing confidence in the sector’s commercial potential.

Two areas have emerged as particular hotspots for investment activity, and I felt that it was important to focus on these throughout this week’s blog post. Brain-computer interfaces (BCIs) have attracted significant capital, with companies like Neuralink & Synchron leading the charge. Synchron’s successful $75M Series C round in late 2024 demonstrated strong investor confidence in minimally invasive BCI approaches. The BCI segment has seen average Series A rounds of $8-15M for companies with promising preliminary data. Series B rounds typically range from $30-50M for those with early clinical validation.

The AI-driven therapeutics space has also shown remarkable momentum. Early-stage companies developing AI-powered diagnostic tools have secured healthy seed funding, typically from $1.5-4M. More established players with validated algorithms have attracted Series A rounds averaging $18M, mainly when targeting conditions like Alzheimer’s or Parkinson’s. Strategic investors, including major pharmaceutical companies, have shown increasing interest, with corporate venture capital participating in 38% of deals above $10M in 2024.

Leading VC Players in Neurotech

The neurotech investment landscape is shaped by a diverse mix of specialized healthcare VCs, technology-focused funds, and corporate venture arms. JAZZ Venture Partners has emerged as a particularly active player, with over 15 neurotech investments in their portfolio and an average initial check size of $7-10M. Their successful exits include several neuromodulation companies, demonstrating the potential for significant returns in this space.

Khosla Ventures has taken a different approach, focusing heavily on the intersection of AI and neuroscience. Their investment thesis emphasizes scalable platforms, with notable successes in AI-driven diagnostic tools and digital therapeutics. Their typical Series A investments range from $8-15M, with substantial reserves for follow-on funding in successful portfolio companies.

Corporate venture arms have also become increasingly active, with Johnson & Johnson Innovation (JJDC) and GV (formerly Google Ventures) leading the way. JJDC has shown particular interest in neurosurgical devices and BCI technologies, while GV has focused on AI-enabled drug discovery platforms for neurological conditions. These strategic investors typically participate in rounds of $20M or larger, often bringing valuable commercial partnerships alongside their capital.

The emergence of specialist funds like Neurotech Ventures and Brain Capital has brought deeper domain expertise to the space. These focused investors typically lead seed rounds of $2-5M and participate in Series A rounds, offering portfolio companies significant support in navigating regulatory pathways and forming strategic partnerships. Their specialized knowledge has proven particularly valuable in de-risking early-stage neurotech investments.

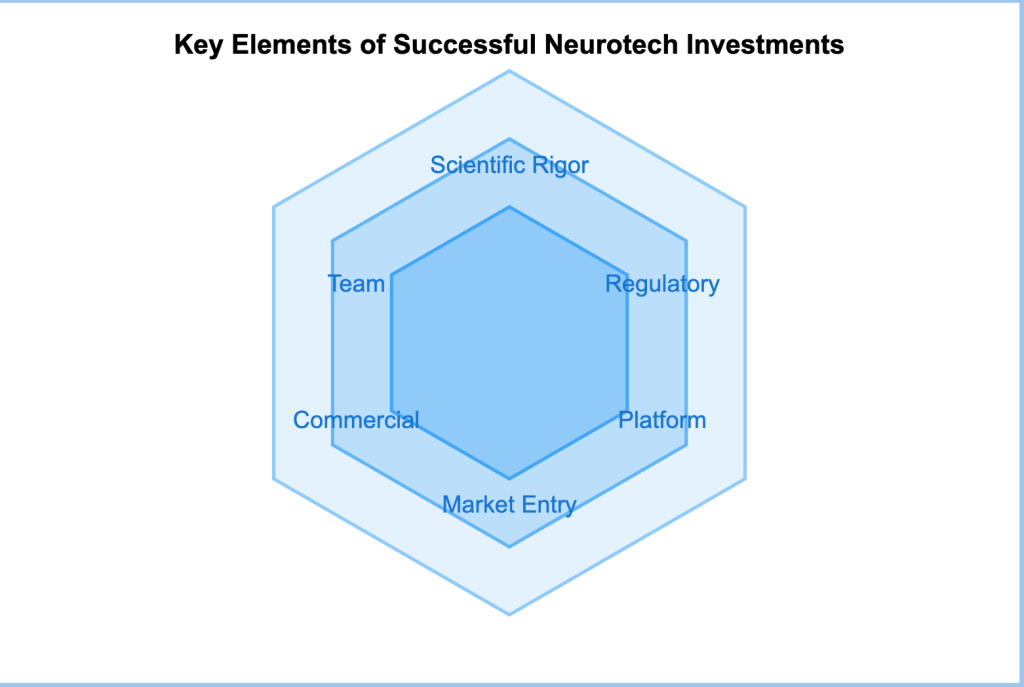

What Sets Successful Neurotech Investments Apart

Investment patterns reveal that successful neurotech companies excel across multiple dimensions, with specific characteristics consistently attracting premium valuations. The most successful Series A rounds ($15M+) typically feature companies with strong IP portfolios and preliminary clinical data. At the same time, seed-stage investments increasingly favor teams with prior exits in adjacent healthcare sectors.

1. Scientific Rigor Meets Commercial Viability

The intersection of scientific excellence and commercial potential has proven to be a crucial success factor. Kernel, founded by Bryan Johnson, exemplifies this balance perfectly. Their team has published multiple papers in Nature Neuroscience and Science, while simultaneously developing commercially viable brain measurement technology. Their success in raising over $225M demonstrates how strong scientific foundations can attract significant investment.

Companies that have secured Series B rounds of $40M or more typically feature research teams with multiple high-impact publications and at least three granted patents in their core technology. Precision Neuroscience, another excellent example, has secured substantial funding by combining academic excellence with clear commercial applications. Their team includes leading researchers from Columbia University, and they’ve developed a novel thin-film brain-computer interface. Their approach to parallel processing in neural recordings has resulted in 12 granted patents, helping them secure a $41M Series B round in 2024.

Recent investment data shows that startups with mixed advisory boards – combining academic experts and industry veterans – raise 60% more capital on average than those with purely academic advisors. Venture firms are particularly attracted to companies demonstrating clear advantages over existing solutions through quantifiable metrics. For instance, AI diagnostic platforms showing accuracy improvements of at least 25% over current standards have commanded pre-money valuations 2.5x higher than comparable companies without such clear differentiation.

2. Regulatory Strategy: A Clear Path Forward

The regulatory landscape has become a key differentiator in investment decisions. Analysis of recent funding rounds reveals that companies with clearly defined regulatory strategies secure funding 40% faster than those without. Successful neurotech startups typically allocate 15-20% of their Series A funding to regulatory and clinical affairs, a benchmark that has emerged from analyzing over 50 successful Series A rounds in 2024.

Neuralink’s methodical approach to FDA approval, despite initial setbacks, demonstrates the importance of regulatory persistence. They’ve invested heavily in regulatory affairs, with a team of former FDA officials, and have successfully addressed safety concerns through systematic testing and documentation. This approach culminated in their successful clinical trial approval in 2024.

Companies that engage early with regulatory bodies have shown particular success in fundraising. Those with pre-submission meetings completed before Series A raises secured an average of 30% more capital than those without such engagement. The data also shows that startups with team members experienced in FDA submissions command premium valuations, with pre-money valuations typically 1.8x higher than comparable companies lacking this expertise.

3. Platform Potential

Investment trends strongly favor platforms that demonstrate versatility across multiple applications. Companies with technology platforms addressing three or more distinct indications have attracted average Series A rounds of $22M, compared to $14M for single-indication focus. This multiplier effect becomes even more pronounced at Series B, where platform companies command valuations 2.3x higher than single-application competitors.

Rune Labs represents an excellent example of platform thinking in neurotech. Starting with Parkinson’s disease monitoring, they’ve built a broad data platform that now supports multiple neurological conditions. Their StrivePD ecosystem has expanded from patient monitoring to clinical trial support and drug development optimization, leading to a successful $65M Series B round.

Delix Therapeutics demonstrates platform potential in a different way. Their neuroplasticity platform, initially focused on depression, has shown applications across multiple psychiatric conditions. This broad potential helped them secure $70M in Series B funding, with investors particularly attracted to their ability to generate multiple drug candidates from a single scientific foundation.

4. Market Entry Strategy

Successful market entry strategies have emerged as a critical factor in securing later-stage funding. Companies with established partnerships with major healthcare providers or pharmaceutical companies have raised Series B rounds averaging $45M, compared to $28M for those without such partnerships. The data shows that startups with clear reimbursement strategies and pilot programs with major healthcare systems raise capital at valuations 70% higher than those focused solely on technology development.

Cognito Therapeutics has executed a particularly effective market entry strategy. By focusing initially on Alzheimer’s disease with their light and sound therapy platform, they identified a clear beachhead market with high unmet need. Their approach to building clinical evidence through partnerships with major medical centers helped secure both FDA Breakthrough Device Designation and significant investor interest.

Numinent stands out for their staged market entry approach in the digital therapeutics space. They first established efficacy in ADHD treatment through partnerships with three major healthcare systems, creating a clear reimbursement pathway. This focused approach helped them secure contracts with major insurers before expanding into adjacent conditions, ultimately leading to a successful $45M Series C round.

Recent investment patterns reveal that companies targeting initial markets of at least $500M, with clear expansion potential to $1B+, attract the most competitive term sheets. Startups that have secured early agreements with healthcare providers for pilot programs have shown powerful fundraising success, with average deal sizes 45% larger than companies without such arrangements.

Case Study: Synchron’s Path to Success

Synchron’s journey provides valuable insights into what investors seek in neurotech companies. Their $75M Series C round in 2024 marked a significant milestone, with participation from both traditional VCs and strategic healthcare investors. The company’s success in securing this funding was built on several key metrics: successful implantation in multiple patients, a clear regulatory pathway with FDA breakthrough designation, and strategic partnerships with seven major medical centers.

The company’s valuation growth tells an important story: from a $30M post-money valuation at Series A to over $800M post-Series C. This 26x value creation was driven by systematic de-risking across technical, regulatory, and commercial dimensions. Their approach to clinical trials, focusing initially on severe paralysis patients while maintaining optionality for broader applications, has become a model for platform-based neurotech companies.

Future Opportunities: Where Smart Money is Heading

Investment data from the past 18 months reveals emerging patterns in neurotech funding. Early-stage investors are increasingly focusing on three key areas, with deal sizes reflecting their potential:

Personalized neuromedicine has emerged as the fastest-growing segment, with average seed rounds of $4.5M and Series A rounds reaching $25M for companies with validated AI platforms. The market potential, projected to reach $5.8B by 2027, has attracted significant interest from both traditional biotech VCs and tech-focused investors.

Digital therapeutics for mental health have seen particular momentum in early-stage funding, with average seed rounds of $3.8M and Series A rounds averaging $18M. Companies in this space with FDA breakthrough designations have commanded premium valuations, averaging 2.2x higher than comparable companies without such designations.

Next-generation BCI companies have attracted the largest early-stage rounds, with seed investments averaging $5.2M and Series A rounds frequently exceeding $30M. This reflects both the technical complexity and massive market potential of BCI technologies, with successful companies typically showing strong IP portfolios and clear paths to human trials.

Investment Considerations for 2025

Recent investment patterns suggest a maturing market with increasingly sophisticated evaluation criteria. Successful raises in 2024 show that investors place premium valuations on companies with comprehensive risk mitigation strategies across multiple dimensions. Pre-money valuations for Series A rounds have averaged $40-60M for companies with strong IP portfolios, preliminary clinical data, and clear regulatory strategies.

The data shows that companies with mixed technical and commercial teams raise larger rounds, with average increases of 40% in deal size compared to technically-focused teams. Furthermore, startups demonstrating clear cost-effectiveness metrics for their solutions have secured valuations averaging 2.1x higher than those without such evidence.

Conclusion: The Road Ahead

The neurotech sector represents an attractive investment opportunity, with total funding expected to exceed $6.5B in 2025. However, it’s important to note that such projections are subject to various factors and market conditions. Success in this space requires a careful balance of scientific excellence, regulatory preparation, and commercial strategy. The most successful investments of 2024 have shown that while deep technology remains crucial, commercial execution and regulatory navigation are equally important for value creation.

For investors, the key lessons from recent exits are clear: successful outcomes require patience coupled with strategic support. The most successful exits have come from companies that achieved multiple derisking milestones:

- Clinical validation across multiple patient populations

- Regulatory approvals in major markets

- Strategic partnerships with established healthcare players

- Robust IP portfolios with broad protection

- Clear reimbursement pathways

- Scalable manufacturing processes

As competition intensifies for high-quality assets, particularly those with validated technology platforms and clear regulatory pathways, early-stage investors who can identify and support companies with strong scientific foundations and commercial execution will find themselves well-positioned to capitalize on this momentum. With multiple billion-dollar exits establishing clear benchmarks and strategic buyers actively seeking acquisitions in AI-enabled diagnostics and digital therapeutics, the neurotech sector presents a compelling opportunity for investors ready to support the next wave of breakthrough innovations in neuroscience.

Discover more from Neural Frontiers

Subscribe to get the latest posts sent to your email.